Housing Language Basics

Affordable Housing

What is Affordable Housing?

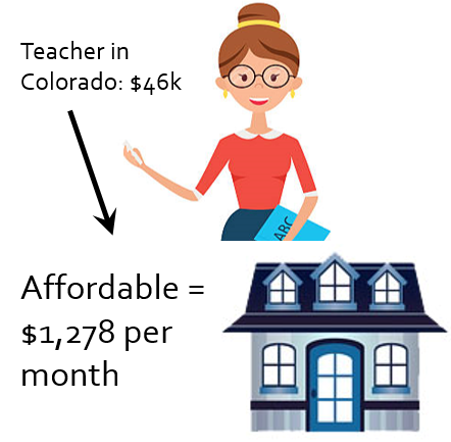

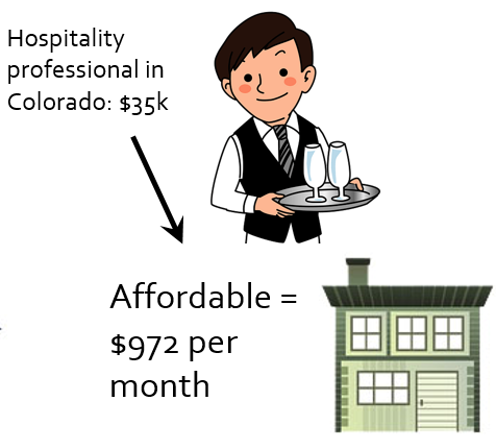

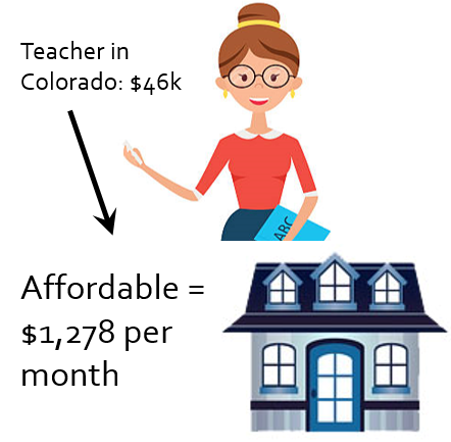

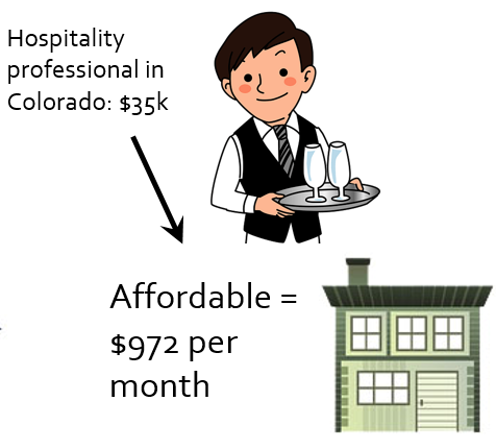

- Affordable housing is generally defined as housing on which the occupant is paying no more than 30% of their gross income for housing costs, including utilities.

- Which means affordable is going to look different to different people.

Teacher in Colorado: $46k; Affordable = $1,278 per month

Registered Nurse in Colorado: $50k; Affordable = $212,000

Hospitality Professional in Colorado: $35k; Affordable = $972 per month

Surgeon in Colorado: $300k; Affordable = $1.2 million

- All over the U.S. there is a shortage of affordable housing for people with lower incomes.

AMI

Area Median Income

- Area Median Income per household which is derived from census data

- The area median income is the midpoint of a region's income distribution, meaning that half of households in a region earn more than the median and half earn less than the median. A household's income is calculated by its gross income, which is the total income received before taxes and other payroll deductions.

- According to HUD (U.S. Department of Housing and Urban Development) the AMI in Alamosa for a 4 member household is $73,500.

- However, our own math puts Alamosa AMI for a 4 member household closer to $58,000

Affordable House/Rent payments at Variable Alamosa AMI (4 person household)

| AMI | INCOME | AFFORDABLE RENT | AFFORDABLE HOUSE | JOB TYPE | JOB SALARY* |

|---|---|---|---|---|---|

| Extremely Low (30%) | $15,315 | $383 | $67,500 | ||

| Very Low (50%) | $25,525 | $638 | $112,600 | Retail Associate | $26,000 |

| 60% | $30,625 | $852 | $150,300 | Teacher | $38,000 |

| Low (80%) | $40,830 | $1,021 | $180,000 | Police Officer | $48,000 |

| 100% | $51,045 | $1,276 | $225,100 | Nurse | $55,000 |

| Moderate (120%) | $61,255 | $1,531 | $270,100 | ||

| 150% | $76,570 | $1,914 | $337,700 | Nurse + Teacher | $93,000 |

*Average Alamosa Job Income

Low Income

What is Low Income?

- Low Income is defined as 80% of the median family income for the area, subject to adjustment for areas with unusually high or low incomes or housing costs.

- Households less than 80% of the AMI are considered low-income

- Households earning less than 50% AMI are considered to be very low income

- Households earning less than 30% AMI are considered extremely low income

LIHTC

What is LIHTC?

- The Low Income Housing Tax Credit (LIHTC) program created by the Tax Reform Act of 1986 gives State and Local LIHTC-allocating agencies the equivalent of approx. $8 billion in annual budget authority to issue tax credits for the acquisition, rehabilitation, or new construction of rental housing targeted to lower-income households.

- There are 9% or 4% tax credit programs for low income housing developers.

- The stipulations include:

- The housing has to remain affordable for 30 years.

- 40% of the housing units must be reserved for households with a 60% AMI and lower and 20% of the units must be for 50% AMI and lower.

Section 8

What is Section 8 Housing?

- “Section 8” is a common name for the Housing Choice Voucher program, funded by the U.S. Department of housing and Urban Development.

- The Section 8 Program allows private landlords to rent apartments and homes at fair market rates to qualified low income tenants, with a rental subsidy.

- The renter receives vouchers that cover part of the cost of rent, then the renter pays the difference between actual rent and subsidy.

- A renter can apply for Section 8 Vouchers at the local Housing Authority

- HUD Section 8 FAQs Website

Housing Authority

What is a housing authority?

- A housing authority is a governmental body that governs aspects of housing often providing low rent or free apartments to qualified residents.

- The Alamosa Housing Authority is a public housing agency that participates in the Section 8 housing Choice voucher program and other public housing programs.

- Alamosa Housing Authority Governing Board

Alamosa Housing Authority Office

213 Murphy Drive Alamosa, CO, 81101

(719)589-6694

alamosaaha.org